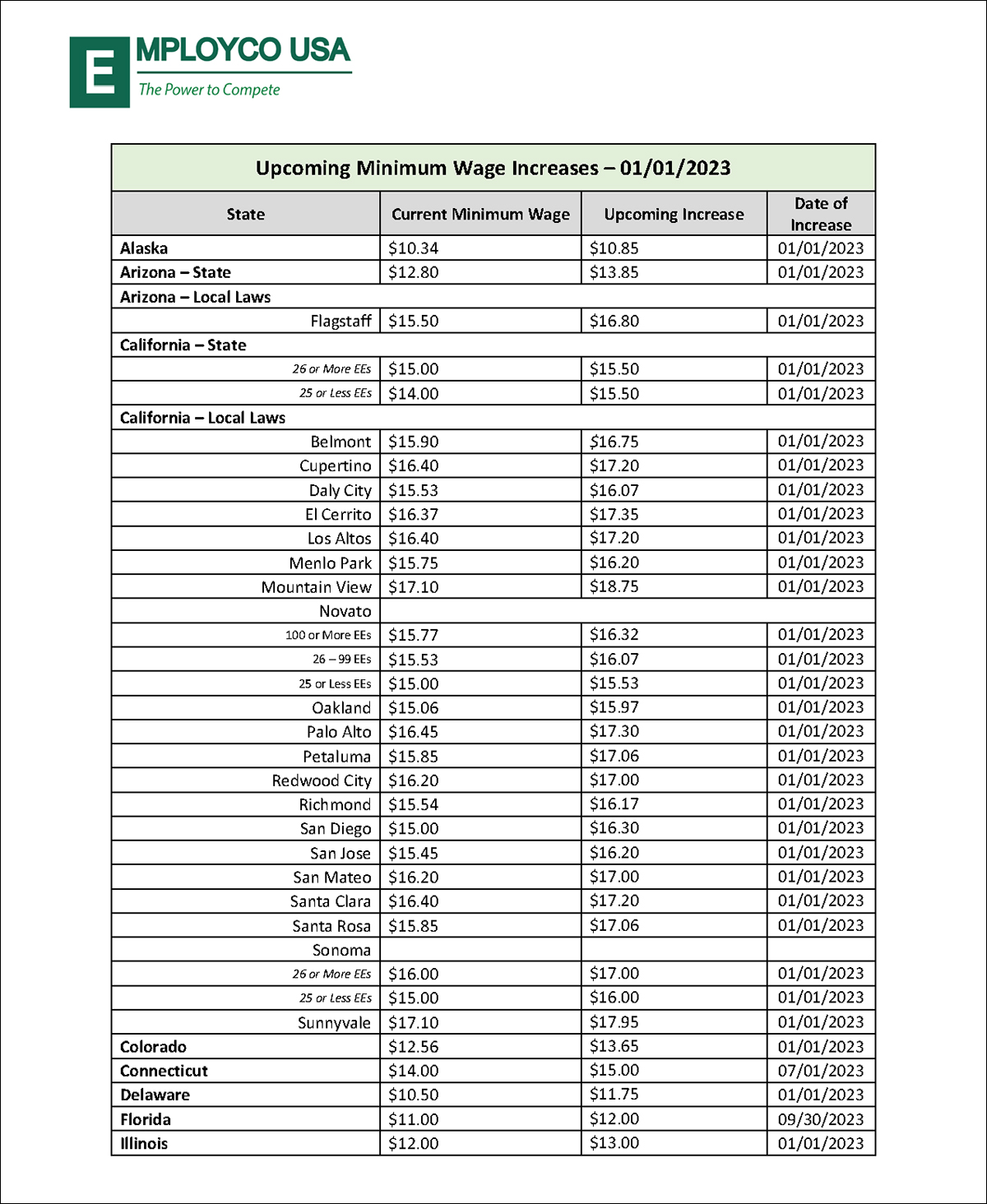

4 HR Trends for 2023: Just as teams quickly adapted to changes at the height of the pandemic, they must now adapt and respond to today’s evolving expectations of organizations and employees. Savvy leaders and HR professionals will approach this year with human-centric strategies that holistically support and benefit workers. The trends include increased wages and raises, pay transparency, and several hot topics. Check out our infographic on 4 HR Trends in 2023.