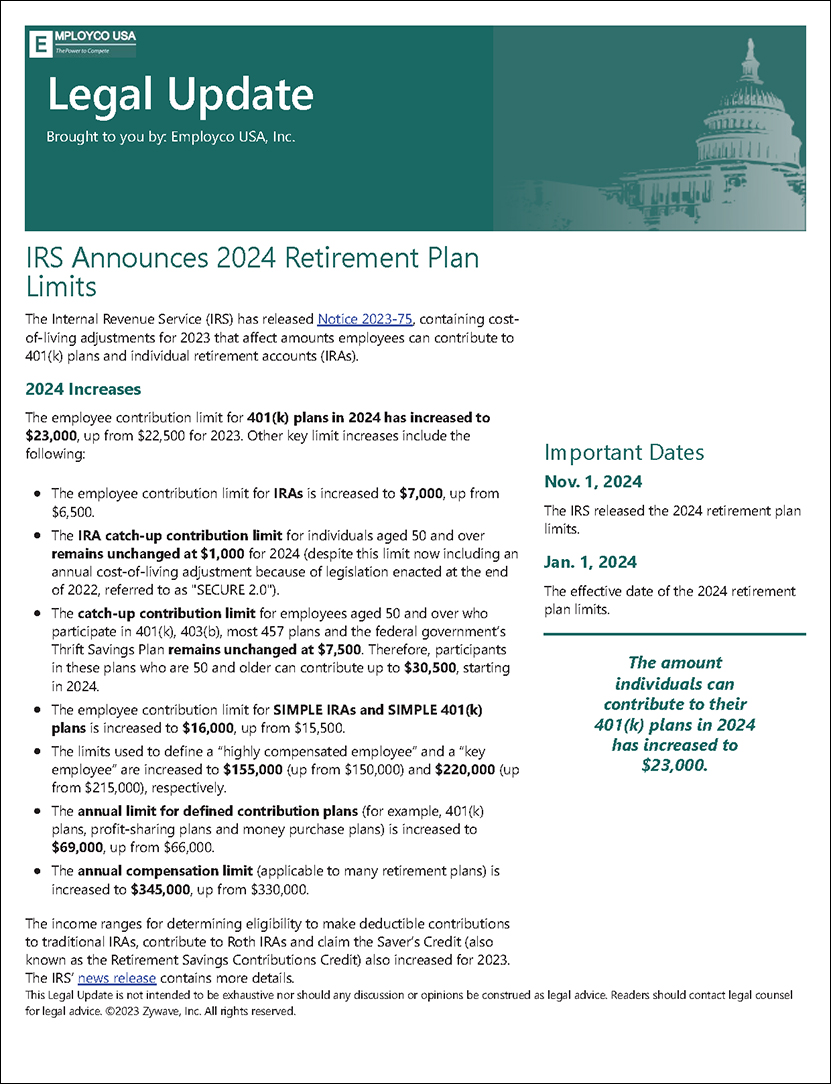

The Internal Revenue Service (IRS) has released Notice 2023-75, containing cost-of-living adjustments for 2023 that affect the amounts employees can contribute to 401(k) plans and individual retirement accounts (IRAs).

| Description | 2024 | 2023 |

| Regular Contribution Limit | $23,000 | $22,500 |

| Catch-up Contribution Limit | $7,500 | $7,500 |

| Employee + Company Limit | $69,000 | $66,000 |

Click the following link to read our Legal Update article on this topic: IRS Announces 2024 Retirement Plan Limits